Terms and Conditions

Reporting

Tektime will publish, in the section of the Portal ("Sales"), the books and audio books sales, indicating copies sold and the relative income.

The data displayed in this section are only for statistical purposes and may change due to local taxation and redemption or refund of purchased books.

These data are not in real-time because sales channels can send them even with delays longer than 30 days.

The official sales data, that will be used to pay the revenue, are only and exclusively those that will be shown in the "Invoices" section.

Translation/narration grant

The translation/narration grant will be considered like a book sale even if it is "special" (Golden copy). So, it will follow the same books sales reporting and payment rules.

Billing request

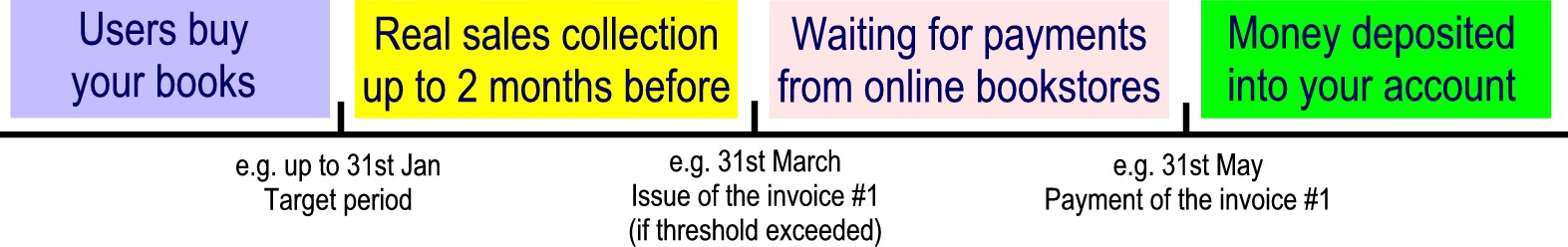

At the end of each month, Tektime will automatically generate a billing request related to the collected book sales revenue up to two months before.

(For example: at the end of April we'll report royalty collected until the end of February).

The invoice will be automatically created by the system. You will be only required to indicate its progressive number and its date of issue, according to your accounting system.

The invoice must be approved by the user and only after its approval, it could be enabled for its payment.

Minimum threshold

In the event that the amount which Tektime has to pay to the user, for the reported period, is less than 50 Euro, that amount will be accrued and accumulated to the royalty of the subsequent month, until reaching the 50 Euro threshold. On exceeding this threshold, the revenue can be paid.

Payments

Tektime, immediately after 60 days of the invoice date, will send the payment to the user, in the way indicated at the time of subscription.Below are the accepted payment methods:

PayPal (*)

PayPal offers companies and individuals, who have an email address, the possibility to send and receive money easily, quickly and safely.

PayPal uses the existing financial infrastructure of bank accounts and credit cards to create a payment system on a global basis and in real time.

Your PayPal account can be used to receive the sales proceeds of your books.

Wise (*)

Wise is the new smart way to convert money into other currencies and sending it abroad or to make international transfers.

By using this service you will receive your payments (if you live abroad) with much lower costs because the fund transfer commissions are up to eight times lower than traditional banks.

You'll find more information on the site www.wise.com

If you sign up by following this link, you will be able to make your first transfer up to € 500, without any commission.

Payoneer (*)

Payoneer offers you a multi-currency account to pay and get paid globally and as seamlessly as possible at the local level.

This all-in-one account provides you with everything you need to receive payments from your international clients and global marketplaces.

ATTENTION! Through Payoneer, you cannot receive payments below the minimum payable threshold of EUR 55.

You can find more information on the website www.payoneer.com

(*) Tektime can not be held responsible in any way for any failure procured by PayPal, Wise or Payoneer, since the services provided by Tektime on this site, are neither directly nor indirectly related to these suppliers.

Currency

Invoices and payments will be made exclusively in EURO. Tektime will not be responsible for any losses resulting from changes in exchange rates in other currencies.

Withholdings

Italian law, in the case of physical persons (individual), requires us to apply the withholding tax indicated in the invoice.

SUBJECTS RESIDENT IN ITALY:

We will send an annual certification report to use in your tax return.

SUBJECTS NON-RESIDENT IN ITALY:

If you meet the necessary requirements and if your country has entered into an agreement to avoid double taxation, you can request the refund of that amount.

All information regarding the procedure to be followed can be found here:

>> ITALIAN REVENUE AGENCY - Agenzia delle entrate (Double taxation relief - tax refund) <<

>> ITALIAN REVENUE AGENCY - Agenzia delle entrate (Claim for a tax refund) <<

Our company details are:

Tektime S.r.l.s. unipersonale

Address: Via Armando Fioretti, 17

05030 – Montefranco – Terni – Italia

P.IVA (VAT N.): 01585300559

PEC: tektime@arubapec.it

GOLD SUBSCRIPTION USERS:

If you meet the necessary requirements and if your country of residence has entered into an agreement to avoid double taxation, it will be possible to request an exemption from the application of withholding tax.

To obtain the exemption, you will need to:

- 1. Verify that your country of residence has entered into a tax treaty with Italy to avoid double taxation. Here you can find a list of countries with an active treaty. Here you can find a list of countries with an active treaty.

- 2. Download this document, complete all necessary parts, digitally sign it, or sign it by hand attaching a valid identification document. Instructions for completing the form can be downloaded by clicking here;

- 3. Request the Certificate of Fiscal Residence against Double Taxation for Royalties from your Tax Agency;

- 4. Combine both documents into a single PDF file and send it to our email address: info@tektime.it.

If all the requirements stipulated by the current regulations are satisfied, we will apply the requested tax reduction.

Flow chart of finance process